CHUNGHWA TELECOM CO (CHT)·Q4 2025 Earnings Summary

Chunghwa Telecom Posts Record Revenue, 8-Year EPS High as 5G Migration Accelerates

February 3, 2026 · by Fintool AI Agent

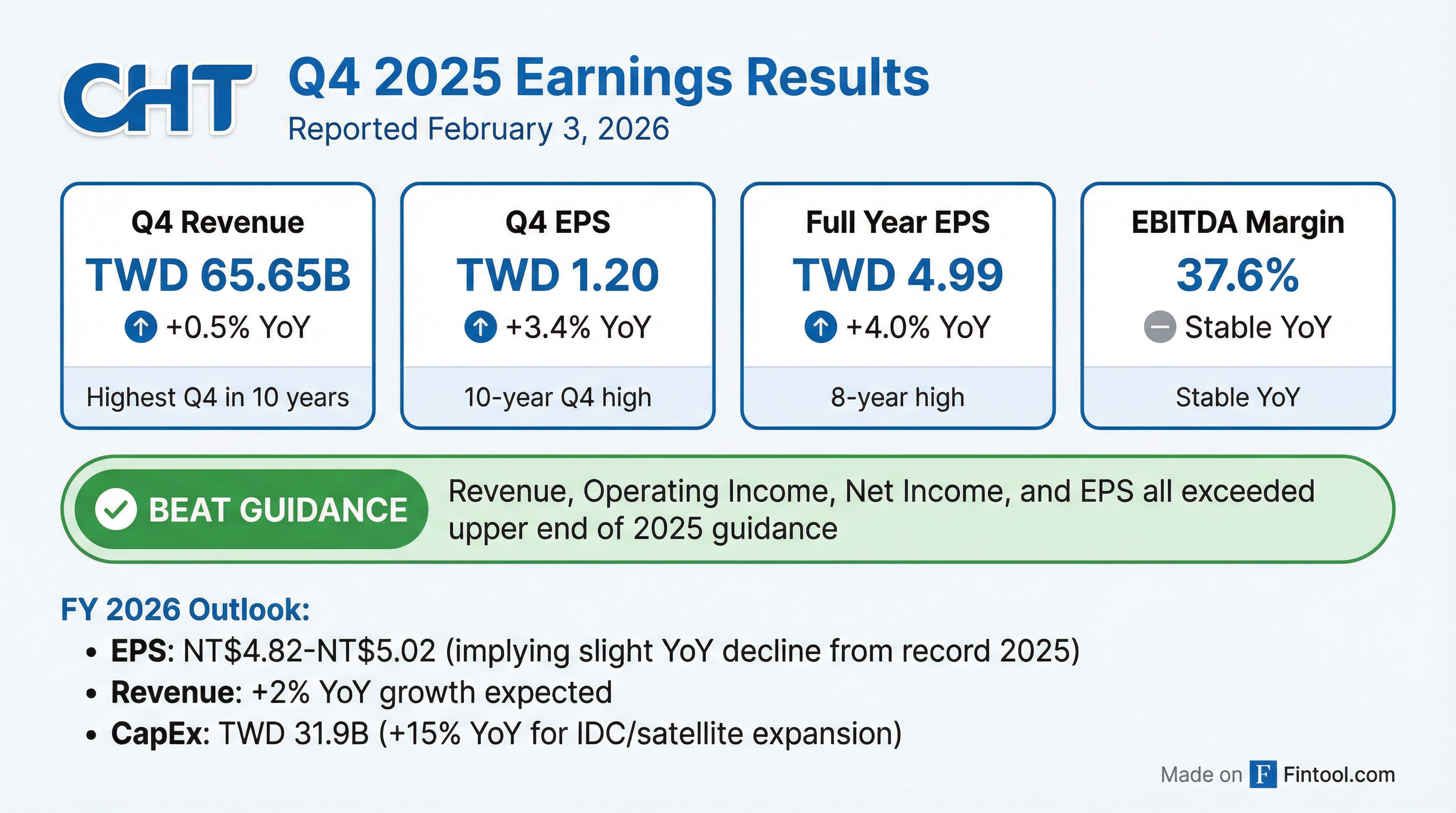

Chunghwa Telecom (NYSE: CHT), Taiwan's largest telecommunications company, delivered exceptional Q4 2025 results with full-year metrics exceeding guidance across the board. Full-year EPS of TWD 4.99 reached an 8-year high, extending the company's annual growth streak to six consecutive years . Revenue hit an all-time record at TWD 236.11 billion, up 2.7% year-over-year .

Did Chunghwa Telecom Beat Earnings?

Chunghwa delivered a comprehensive beat against its 2025 guidance:

*Source: *

The Q4 results represent the highest fourth-quarter revenue in nearly a decade and the highest Q4 EPS in 10 years . Management highlighted that revenue, operating income, income before tax, and EPS all exceeded the upper end of 2025 guidance .

What Drove the Record Performance?

Mobile Business Dominance

CHT solidified its leadership in Taiwan's mobile market with record market shares :

- Mobile revenue market share: 41% (unprecedented high)

- Subscriber market share: 39.7%, driven by postpaid growth

- 5G subscriber share: 39.2%

- 5G penetration rate: 46.4% among smartphone users

- 5G migration fee uplift: 41% average monthly increase

- Mobile service revenue growth: 4.7% YoY (recent record high)

Postpaid ARPU grew 3.6% year-over-year, with management expecting this positive trajectory to continue given Taiwan's favorable mobile market landscape .

Fixed Broadband Momentum

Fixed broadband ARPU reached a new high of NT$819 per month, representing 3.8% revenue growth and 0.5% subscriber growth . High-speed adoption accelerated:

- 300 Mbps+ subscribers: +13% YoY

- 500 Mbps+ subscribers: Double-digit growth

- 1 Gbps+ subscribers: Doubled in Q4

Multiple play packages (mobile + fixed + Wi-Fi) increased 17% YoY, marking the 16th consecutive quarter of expansion .

How Did the Segments Perform?

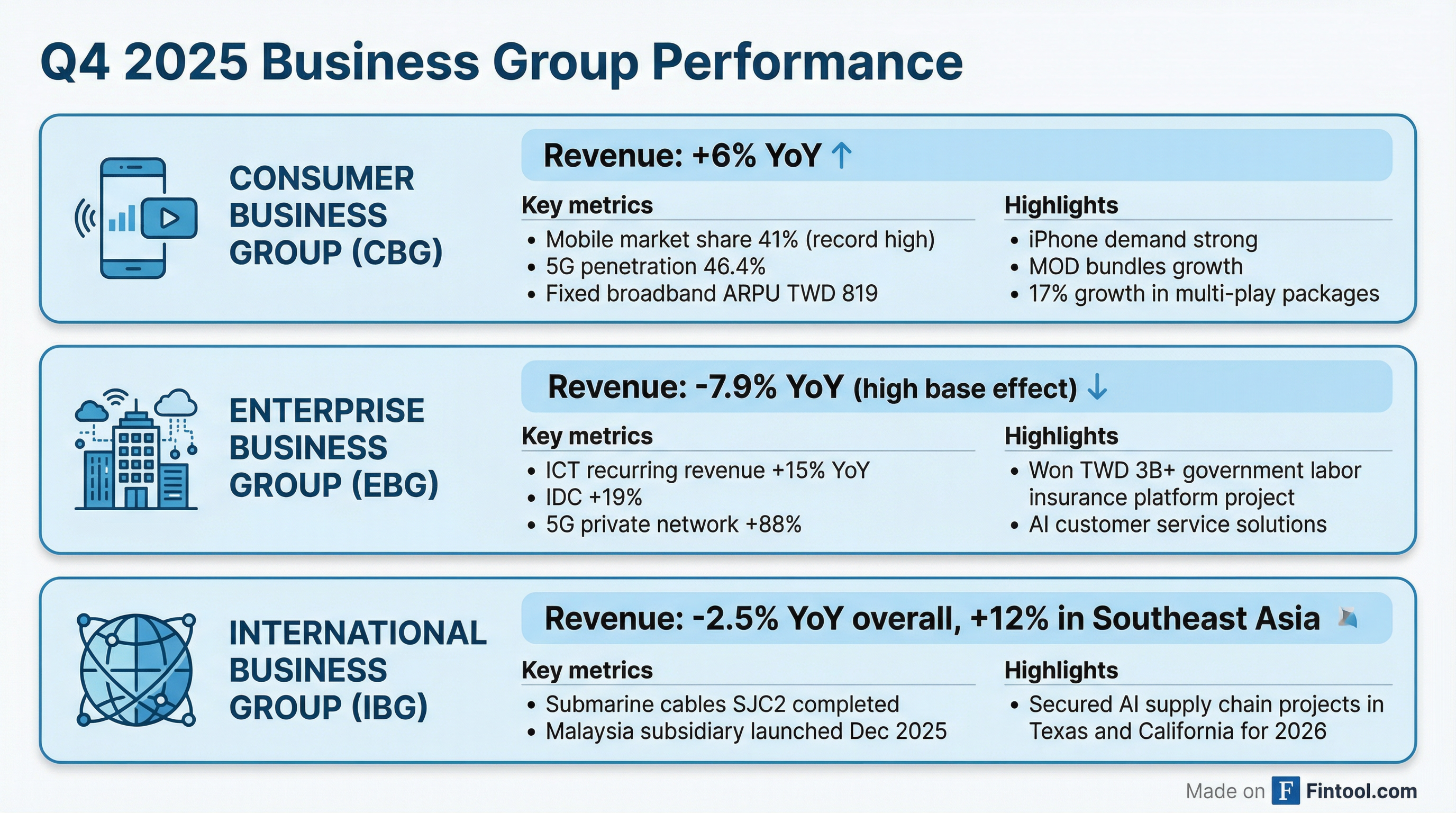

Consumer Business Group (CBG)

CBG delivered 6% YoY revenue growth, supported by steady increases in mobile and fixed broadband services plus higher iPhone-driven handset sales . Income before tax slightly decreased due to final 3G equipment impairment (now fully recognized) and a higher comparison base from government subsidies in Q4 2024.

Key highlights:

- Disney+ bundle launched January 2026

- Ongoing Netflix partnership

- FIFA World Cup and Asian Games expected to drive 2026 growth

- Consumer cybersecurity subscriptions: +11% YoY with double-digit revenue gains

Enterprise Business Group (EBG)

EBG revenue decreased 7.9% YoY as major ICT projects were recognized in earlier quarters . However, recurring ICT revenue grew 15% YoY with strong momentum across:

Declined due to high base effect; full-year revenue still grew

Notable wins:

- First integrated AI customer service system for a leading Taiwan company

- Labor insurance platform upgrade project: >TWD 3 billion contract value

- Satellite services incorporated into government procurement framework

- Correctional institution surveillance: 5 new projects, ~TWD 150M total value

International Business Group (IBG)

IBG revenue increased 2.5% with income before tax up 1.8% YoY, driven by international IDC demand and stronger roaming revenue . Regional performance was mixed:

- Southeast Asia: +12% YoY from Singapore and Thailand construction projects

- Malaysia subsidiary: Commenced operations December 2025

- US/Japan: Declined due to lower voice demand and high base effects

Submarine cables SJC2 and first phase of Apricot were completed in Q4, boosting fixed line services revenue 2.2% YoY .

What Did Management Guide for 2026?

CFO Audrey Hsu provided the following 2026 outlook :

Capital Allocation Strategy

The 2026 CapEx budget reflects CHT's "sea, land, sky" infrastructure strategy :

Mobile CapEx: Expected to decrease 6.3% YoY — the fifth consecutive year of decline since 2021 peak as 5G construction phase matures. Investment will focus on SA standalone applications like network slicing .

Non-Mobile CapEx: Increasing ~24% YoY, driven by:

- Submarine cable expansion

- IDC/data center construction

- Satellite infrastructure

- Power, cooling, and cybersecurity upgrades

When asked about the non-mobile CapEx increase, CFO Hsu noted that IDC and cloud remain the second-largest portions of non-mobile CapEx, alongside fixed line maintenance and satellite investments .

What Are the Key Growth Catalysts?

President Rong-Shy Lin outlined several strategic priorities :

1. Satellite Expansion

- OneWeb and SES satellites commenced operation in 2025

- Astranis satellite joining H2 2026

- Satellite services positioned as government communication backup solution

2. Pre-6G Opportunities

- Combined revenue from AIOT, satellite, and big data expected to exceed TWD 10 billion in 2026

- Focus on AI-driven connectivity and edge computing

3. AI Integration

- Converting AI capabilities into service offerings

- Helping customers integrate AI into operations, legal compliance, and infrastructure

- Introducing AI edge computing at AIDC for new revenue streams

4. US Market Expansion

- Secured AI supply chain projects in Texas and California

- Expected to significantly boost US market performance in 2026

What About ESG and Recognition?

CHT received multiple awards in Q4 2025 :

- SSG Award for Corporate Sustainability Leadership (5th time)

- Silver AI Innovation Award at World Communication Awards

- Only Taiwanese telecom on "World's Most Trustworthy Companies 2025" list

The company secured 4.6 billion kWh of renewable energy through a 20-year corporate power purchase agreement (CPPA) to support its 2045 net zero commitment .

How Did the Stock React?

CHT shares traded at $41.82 as of market close on February 2, 2026, down 1.1% ahead of the earnings release. The stock is essentially flat year-to-date (+0.2%) and trades within its 52-week range of $36.12 - $46.95.

Values retrieved from S&P Global

The market will likely focus on the tension between record 2025 results and the guidance implying potential EPS decline in 2026 due to elevated cost investments.

What Should Investors Watch?

Positives:

- Record market shares across mobile metrics

- Recurring ICT revenue growing 15% provides visibility

- US AI supply chain wins could be meaningful in 2026

- Strong balance sheet with net debt/EBITDA at 0

Concerns:

- 2026 EPS guidance midpoint below 2025 record

- Operating cost growth (3.5-3.7%) outpacing revenue growth (~2%)

- Enterprise ICT project timing creates quarterly volatility

- Electricity cost uncertainty in Taiwan

This analysis is based on Chunghwa Telecom's Q4 2025 earnings call held on February 3, 2026. View full transcript.